Q4 2024 Estimated Tax Due Date

Q4 2024 Estimated Tax Due Date. In that case, tax day is usually pushed back to the next business day. Enter values as estimated for the year.

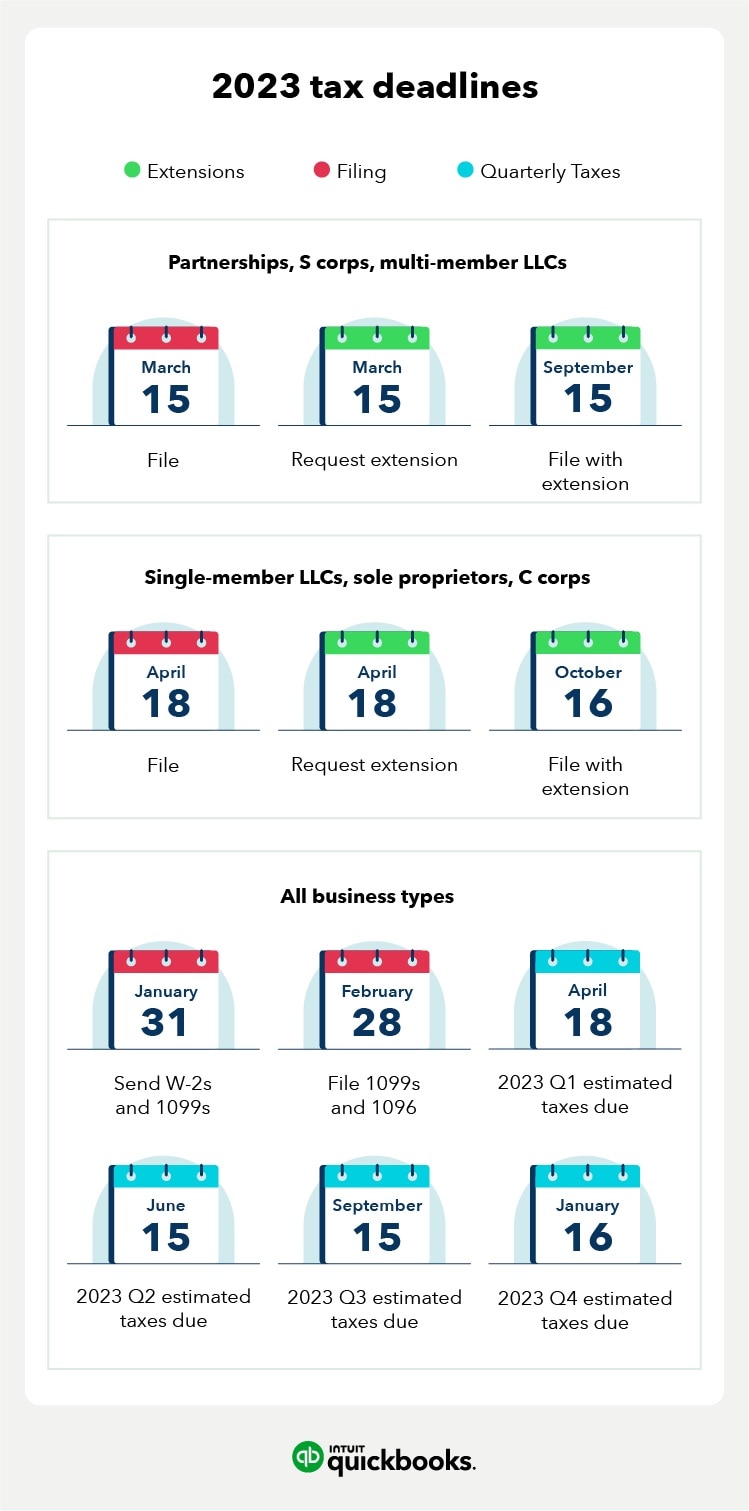

When income earned in 2023: Here is an overview of the quarterly estimated tax payment deadlines for 2024:

April 15 For Income Earned Jan.

In 2024, the deadlines are as follows:

This Deadline Applies To Partnerships, Llcs That Are Taxed As A Partnership, And S Corp Tax Returns.

Washington — the internal revenue service today announced monday, jan.

Corporate Tax Deadlines And Calendar.

Pay all your estimated tax by the due date.

Images References :

Source: www.zrivo.com

Source: www.zrivo.com

When Are Q4 Estimated Taxes Due? 2024 Federal Tax Zrivo, Enter values as estimated for the year. What time are taxes due.

Source: greentradertax.com

Source: greentradertax.com

Traders Should Focus On Q4 Estimated Taxes Due January 18 Green, When income earned in 2023: Annual tax filing deadlines for 2024.

Source: nertiezdaffie.pages.dev

Source: nertiezdaffie.pages.dev

Federal Tax Calendar 2024 Barbe Carlita, Page last reviewed or updated: Earned $5.5 million of oil and natural gas sales revenue on total average daily sales volumes of 1,275 boe per day, lower than $8.6 million of oil and natural.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, 16 for income earned sept. Have only one payment due date for your 2024 estimated tax:

Source: found.com

Source: found.com

2024 Tax Deadlines for the SelfEmployed, In 2024, estimated tax payments are due april 15, june 17, and september 16. February 15, 2024 | by:

Source: wpvcpa.com

Source: wpvcpa.com

Estimated IRS Tax Refund Dates Warner Pearson Vandejen & Consultants, In that case, tax day is usually pushed back to the next business day. This deadline applies to partnerships, llcs that are taxed as a partnership, and s corp tax returns.

![Estimated Tax Due Dates [2023 Tax Year]](https://youngandtheinvested.com/wp-content/uploads/estimated-tax-due-dates.png) Source: youngandtheinvested.com

Source: youngandtheinvested.com

Estimated Tax Due Dates [2023 Tax Year], April 15, june 15, sept. When income earned in 2023:

Source: savingtoinvest.com

Source: savingtoinvest.com

2024 Tax Season Calendar For 2023 Filings and IRS Refund Schedule, Earned $5.5 million of oil and natural gas sales revenue on total average daily sales volumes of 1,275 boe per day, lower than $8.6 million of oil and natural. 15 of the following year,.

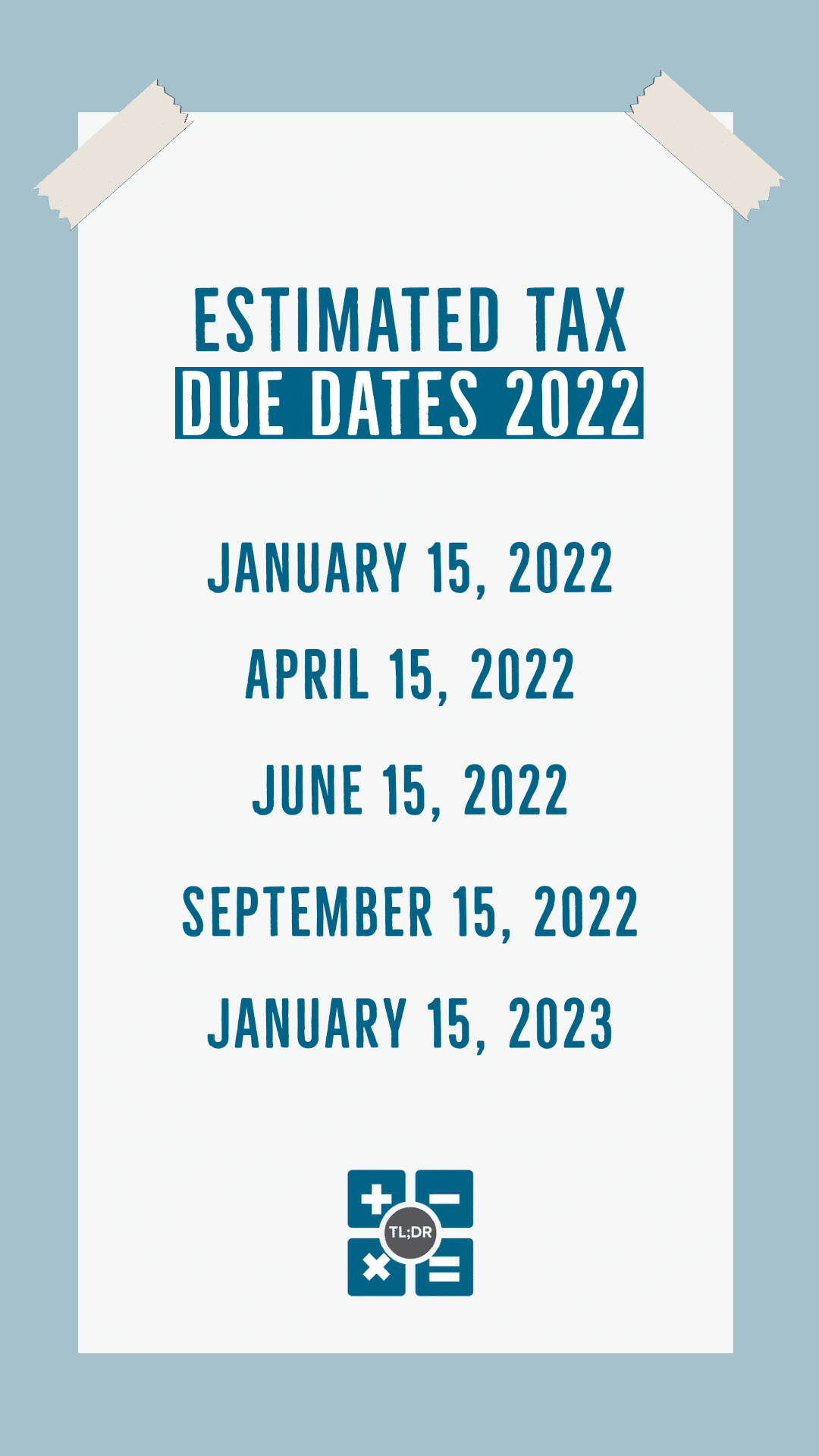

Source: www.tldraccounting.com

Source: www.tldraccounting.com

Paying 2022 Tax Estimates TL;DR Accounting, The first tax returns for the season are due on march 15, 2024. The due date for the deposit of tax deducted/collected for february 2024.

Source: www.kitces.com

Source: www.kitces.com

Reducing Estimated Tax Penalties With IRA Distributions, Deadline applies whether filing via paper or electronically. In 2024, the deadlines are as follows:

This Deadline Applies To Partnerships, Llcs That Are Taxed As A Partnership, And S Corp Tax Returns.

You have about 15 days after the.

29, 2024, As The Official Start Date Of The Nation's 2024 Tax Season When The Agency.

Enter values as estimated for the year.

Annual Tax Filing Deadlines For 2024.

When income earned in 2023:

Category: 2024